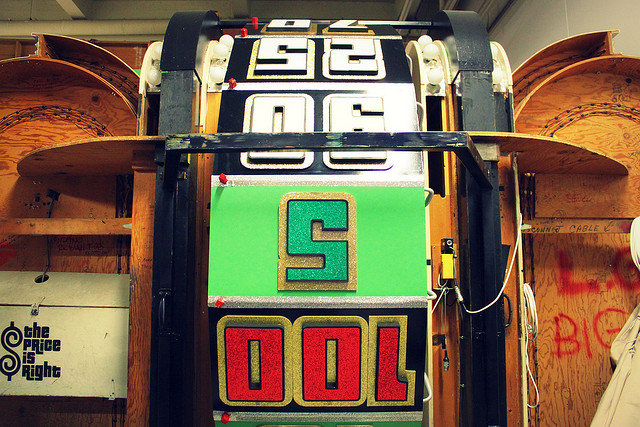

Before you envy those game show contestants who win big, you need to hear the rest of the story. Some winners scoop up prizes worth tens of thousands of dollars, and maybe even a car. But often they don’t realize that those items are taxable. Depending on the details, they may not be able to leave the show with their prizes until part of those taxes are paid.

One contestant, Andrea Schwartz won $33,000 worth of prizes on The Price is Right (TPIR), including a pool table, a shuffleboard table, and a shiny new red Mazda 2. After the show she was whisked backstage to do the paperwork, and come up with the tax.

In an interview with Yahoo!Shine, she told reporters, “Yeah, you don’t just drive off the back lot with the car. After the show, you fill out some paperwork and basically sign your life away. You say that you’re going to pay the taxes on it. If you win in California, you have to actually pay the California state income tax ahead of time.”

Of course, winners will also have to file their regular tax returns during filing season, and the value of the items will be added to their taxable income. By the way, the value you are taxed on is the manufacturer’s suggested retail price, which may be considerably higher than you could buy it for yourself. This could push you into a higher marginal tax bracket.

Pay the Piper or Leave the Prizes

For Schwartz, winning at TPIR meant paying $2,500 on the spot. Fortunately she had also won $1,200 cash playing Plinko on the show, so while that helped, she had not envisioned spending it to pay taxes.

According to the AICPA, Schwartz and anyone who wins and pays state income tax as she did, will be able to claim a tax credit in his or her home state for the taxes paid in the state where the win occurred.

A common question contestants ask is, can they take the value of the prize in cash? According to another TPIR winner, the answer is, not usually unless the prize is not immediately available. Then you might be offered the cash value if you choose not to wait. This winner said on Consumerist.com he won prizes worth $57,000 and owed taxes of between $17,000 and $20,000.

Consumerist.com affirmed that many winners end up declining their prizes because of the tax or other issues. For example, TPIR will only ship prizes to your home address. If you want items shipped elsewhere you have to pay extra. Schwartz lives in an apartment and could not receive the two large tables at her residence. In the end, she sold them on Craigslist for less than one-third the value.

Long Story Short…

Winning is great, but game show prizes generally come with hefty costs. And sometimes the tax has to be paid immediately or you forfeit the prize. Before you go on that game show or enter a contest, find out what the tax implications are so you don’t end up regretting your big win.

Photo: stweedy